Philanthropy must continue to help regulators understand climate change risks and how they will impact financial systems.

Central banks are in the news and for good reason. The Covid-19 pandemic and resulting economic turbulence, along with Russia’s invasion of Ukraine, have tested the abilities of these regulatory bodies. Amid these crises, the actions of central banks have reminded us of their power to effect change in our lives through monetary policy and their influence as they flex their intellectual weight in attempts to guide our economies toward a better path. And while this near-term focus is warranted, there is growing recognition that more crises are on the way, including those tied to the effects of climate change. However, the question remains whether central banks are prepared to respond.

At a minimum, the mandate of central banks and supervisors is to oversee the stability of national economies. Understanding these risks falls within the mission of these regulators. However, there are two areas that central banks and supervisors have traditionally overlooked in their risk assessments and scenario planning: (1) the physical impacts of climate-fueled natural disasters, which have been on the rise; and (2) the unforeseen transition risks created by climate-related shifts in policy, technology, consumer sentiment, or legal liabilities. Fundamentally, the failure of central banks and supervisors to understand how climate risks affect their economies represents a failure to perform their duty to the financial system.

With philanthropy’s support, central banks and supervisors can help make the financial economy more resilient to environmental shocks by incentivizing the financial system to minimize its exposures to the very sectors that drive these shocks.

Better planning for a resilient future

To help address these gaps, ClimateWorks Foundation has supported a consortium of academic organizations, researchers, and climate modelers who provide analytical support to the Network of Central Banks and Supervisors for Greening the Financial System (NGFS), a group of regulators that builds policies to address climate- and nature-related issues. The network includes the Potsdam Institute for Climate Impact Research, the International Institute for Applied Systems Analysis, the Center for Global Sustainability at the University of Maryland, Climate Analytics, and the National Institute of Economic and Social Research.

Central banks and supervisors are typically independent authorities that must base their decision-making on careful analysis and the construction of a strong evidence base that can inform their policies. This requires crucial data and analysis, and for such exercises, the academic consortium of modelers supported by ClimateWorks has created, updated, and supported the implementation and uptake of the NGFS Climate Scenarios. The third wave of updates to these scenarios, referred to as “vintage number three,” was released in September 2022. The scenarios provide a whole-economy approach to understanding climate risks from which NGFS central bankers can pilot their policy responses.

Working in close partnership with NGFS, modelers have created the only set of climate scenarios tailored to the analytical needs of central bankers and supervisors. This initiative is part of ClimateWorks’ finance strategy to help regulatory institutions understand how net-zero transitions can benefit all economies.

NGFS Climate Scenarios continue to evolve

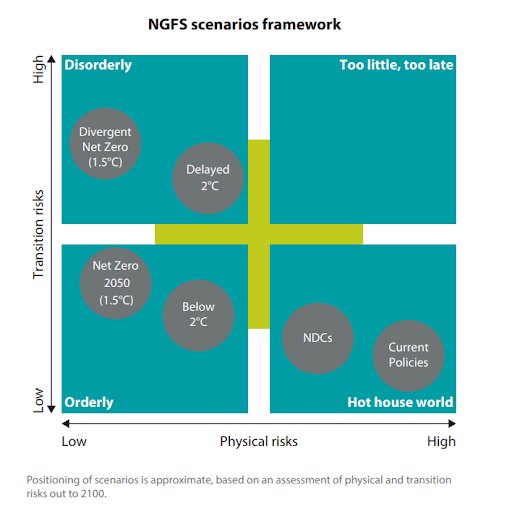

The NGFS scenarios illustrate six different economic pathways under various levels of public and private responses to climate risks. The scenarios are not forecasts; instead, they provide a rubric to measure risk exposures under various climate policy scenarios. Low-risk scenarios depict timely or “orderly” responses; high-risk economic scenarios depict “disorderly” or delayed reactions to climate risks; and severe-risk scenarios result from current levels of action on climate. In the worst-case scenarios, climate risks have significant impacts on GDP.

Central banks’ and supervisors’ understanding of climate risks can lead to policies that mitigate and increase resilience to future climate impacts. Central banks and supervisors can use these scenarios as a part of stress tests, for example, to inform policies that regulate financial institutions’ risk exposures to high-emitting sectors, which might limit the flow of capital to and thus exposure to risky sectors.

The scenarios have come a long way in a short amount of time. With each phase, ClimateWorks’ grantees have improved their technical capacity and data offerings in response to feedback from a wide range of stakeholders. There are several ways that grantees can further advance their efforts. They can:

- Incorporate of more macroeconomic factors (especially important given the effects of Covid-19 and related economic crises);

- Increase a granular focus on economic impacts on key sectors and various geographies;

- Publish a wider range of scenarios, including an ensemble of Net-Zero Scenarios and Divergent and Disorderly Scenarios simulating higher levels of transition and physical risk;

- Integrate of a wider range of physical impacts and their effect on the economy; and

- Improve clarity on the alignment between the NGFS Scenarios and other climate scenarios, such as the International Energy Agency’s World Energy Outlook.

While the third vintage of scenarios does not account for the Russia-Ukraine war, their outputs do anticipate economic stressors within scenario narratives. These scenarios attempt to measure how fluctuations in energy markets and climatic impacts have circular effects on the economy. As the economic impacts of combined energy and geopolitical shocks become more clear, the NGFS scenarios can continue to evolve and shed more light on future risks to the global financial system.

Work remains to demystify the level of ambition in the scenarios and their ability to model future economic risks. Central banks and regulators can address these gaps by incorporating the scenarios into their analytic operations, then setting the tone on climate ambition.

Areas for philanthropic support

The philanthropic community can build on existing momentum with the NGFS to speed the uptake of decision-useful research, such as the climate scenarios, and standardize pathways through which such information can lead to policy. Philanthropy can step up and help:

- Scale research that updates and expands scenario development that underpins a more granular understanding of climate risks;

- Support technical capacity for central banks and regulators to absorb and integrate the Climate Scenarios and related research;

- Develop global standards for the use of scenarios by central banks and supervisors; and

- Support the uptake, translation, and interpretation of these scenarios for use within the broader financial field.

With philanthropy’s support, central banks and supervisors can help make the financial economy more resilient to environmental shocks by incentivizing the financial system to minimize its exposures to the very sectors that drive these shocks.