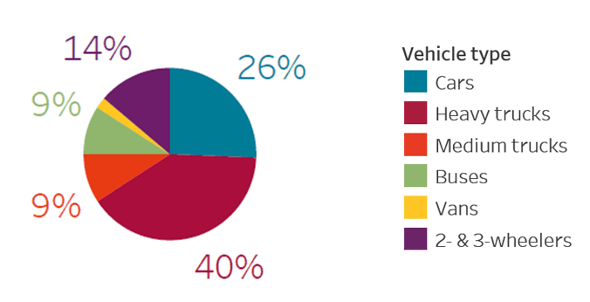

Transportation electrification is at the forefront of climate action and energy security in India, as road transportation comprises 90% of the country’s transport emissions. Currently, India has ambitious targets and policy pathways laid out under the Faster Adoption and Manufacturing of Electric Vehicles (FAME) I and II umbrella and associated schemes like the Production Linked Incentives (PLI) for electric vehicles and components. These programs largely target two- and three-wheelers, passenger cars, and buses. However, the rapidly rising demand for road freight has elevated the importance of decarbonizing the heavy trucking segment.

In India, medium- and heavy-duty trucking account for only 2% of vehicles on the road but contribute 40% of the total road transportation emissions — more than any other vehicle segment — due to factors such as higher fuel consumption. Globally, less than 1% of medium- and heavy-duty trucks on the road today are zero-emission vehicles, but that is changing quickly in regions with policy support.

With the right mix of policy, regulation, and private- sector engagement, the transition to zero-emission trucks (ZET) can bring multiple economic and environmental benefits. Recent research conducted separately by Lawrence Berkeley National Laboratory (LBNL) and the Climate Group highlight how accelerating the transition to zero-emission trucks can yield economic, environmental, and energy security gains for India.

A win-win opportunity for climate and energy security

Recent improvements in battery costs and energy density have created new opportunities for truck electrification, which were previously not feasible. LBNL’s recent study, “Freight Trucks in India are Primed for Electrification” (October 2022), analyzed the economic and environmental potential of truck electrification through an estimation of production and operation costs based on international battery prices. The results show that when deployed at scale, battery electric trucks can have a lower total cost of ownership compared to diesel trucks across multiple weight classes. Battery electric trucks will have lower fuel costs and more stable fuel prices, a benefit to the trucking industry. Additionally, diesel trucks currently consume 57% of the petroleum used for transportation in India, the majority of which is imported, whereas electric trucks can take advantage of increases in renewable and domestically produced power.

As battery electric trucks replace diesel freight, the climate and local pollution benefits will increase. At the current average grid emissions intensity for India, battery electric trucks can reduce the greenhouse gas intensity of freight by 9% to 35% across different classes of trucks when compared with diesel. The emission reduction benefits of electric trucks will increase in the future as the Indian power grid is projected to become significantly cleaner with 2030 renewable energy targets. Importantly, battery electric models also eliminate air pollution along highways and congested areas. Given that India will add increasing amounts of renewable electricity to its grid, the environmental benefits of electric trucks will only increase over time.

Policy and finance as the accelerators

The LBNL study shows that the commercial viability of the battery electric trucks industry will require sustained policy support. Soon, electric trucks will be less expensive to purchase, fuel, and maintain than diesel or petrol trucks, providing significant economic benefits. Initially, however, electric trucks may have higher upfront costs and, in some cases, higher total cost of ownership compared to diesel trucks. To address this, the existing PLI scheme could be supplemented with additional policies. These could include sales requirements and/or commitments by truck manufacturers and large fleet owners to induce a growing quantity or share of battery electric trucks annually. California’s Advanced Clean Trucks (ACT) regulation exemplifies this approach and underscores the importance of decisive government, civil society, and industry action.

These measures will create certainty for investors and the economies of scale needed to stimulate a positive feedback cycle of higher deployment and lower costs. For example, India has successfully leveraged renewable purchase obligations to achieve significant deployment of low-cost renewable energy. It is now time to consider how a similar approach could help reduce dependence on diesel for trucking.

Making financing available and easily accessible will also be crucial for advancing clean trucking objectives. This is because trucks in India are typically financed and rarely purchased outright. Governments, banks, and other financial institutions can play a role in providing access to low-cost capital and financing options for the upfront cost of electric trucks. This is even more important given imbalanced ownership patterns: only 30% of Indian trucks fleets are medium and large fleet operators, yet they own 70% of freight trucks, while small fleets of less than six trucks account for just 30% of trucks but are 70% of the fleets in operation.

Galvanizing demand-side action

The transition to zero-emission trucks in India requires catalytic action from consumers, investors, and corporate actors. For example, as businesses in India strive to reduce their indirect emissions (also known as scope 3), early adopters could take advantage of freight electrification. The Climate Group’s analysis, “Early market outlook report – Electrification of medium and heavy-duty trucks in India” (October 2022), shows that two trucking segments have the greatest share of on-road trucks: parcels and consumer goods deliveries (~45% of trucks), followed by perishables (~18%). Companies that are big freight users like these that generally employ a third-party logistics provider can influence the service they demand to enable the switch to electric trucks.

To enable this action, the Climate Group launched the EV100+ initiative to bring together companies committed to a 100% shift to zero-emission medium and heavy-duty electric vehicles by 2040. JSW Steel, a leading steel producer, is the first company in India, among five other global companies, to pledge to EV100+. Other companies include IKEA, Unilever, A.P. Moller-Maersk, and GeoPost/DPD group, all of which are among the world’s top consumer goods, shipping, and logistics companies.

Such pledges can translate to breakthroughs, as the Climate Group study asserts that the first offshoots of a switch from diesel to cleaner trucks is already attractive today in certain trucking use cases, and these applications will demonstrate clear feasibility. Such use cases could emerge as early-transition beachheads and garner interest among truck consumers and manufacturers alike.

Philanthropy can help shift electric trucks into the fast lane

Partnerships and collaborations across the trucking supply chain — including truck and battery manufacturers, fleet operators, and charging infrastructure providers — will be key to creating a viable clean trucking market. These collaborations, along with increased public-private engagement, will catalyze the deployment of zero-emission trucks in India. Philanthropy can help create an enabling environment for such collaborations. Additionally, as the LBNL and Climate Group studies show, research can help provide a clearer understanding of the pathways and policies to lowering the total cost of ownership, creating economies of scale, and building investor confidence in the clean trucking segment. Philanthropy can play a vital role in supporting institutions at the forefront of bridging additional knowledge gaps.

India’s decarbonization journey is consistent with its overarching development goals and is rooted in the imperative to provide jobs, ensure energy access, and improve the quality of life of 1.4 billion citizens. Shifting from dirty diesel to clean, zero-emission trucks lies at the intersection of employment, climate mitigation, and improved public health. Philanthropic initiatives can provide support across these objectives and facilitate global information-sharing to unlock policy and financial tools for emerging technologies like battery electric trucks.